Moving to London Guide

Thinking of moving to London? You’re in the right place. London removal experts Compare My Move explore all you need to know about living, working and getting around London.

Cost of Living in London

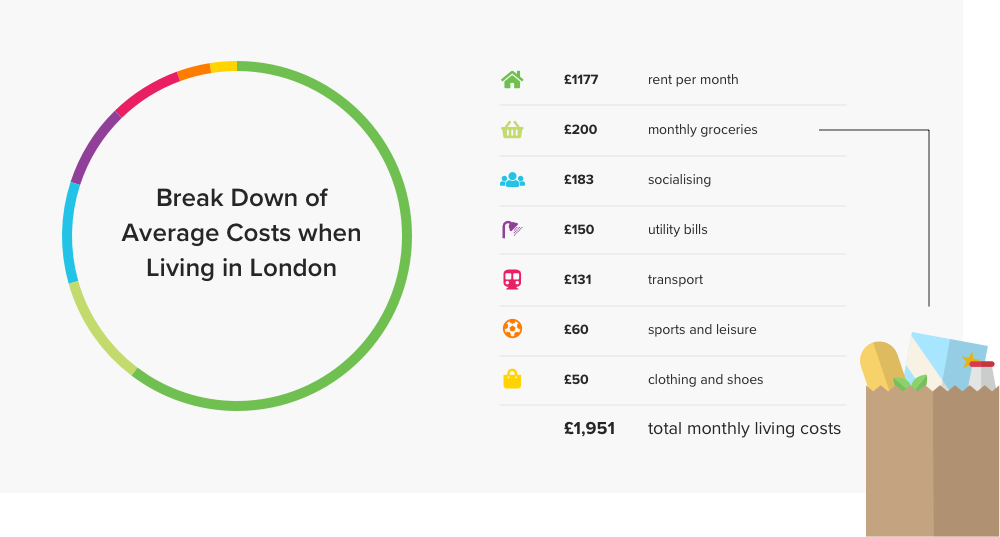

For those living in an average one person apartment outside the city centre, the monthly cost of living in London amounts to £1,951.

There's no denying it - London is an expensive place to live.

Although London sees the most pricey rent in the UK, a higher than average wage helps to soak up these costs.

You'll need to prepare yourself, so here we explore the price of day to day life in London compared to other major cities in the UK, what proportion of your wage will be left after an average month in London, and how you can save money.

Alongside rent of £1,177 for a one person apartment, the average Londoner will spend around £774 on extra living costs a month. These costs include food, clothing, bills, leisure and transport costs.

Here's the breakdown of monthly costs when living in London, use this as a rough guide to what you can expect to pay each month when living in London.

Expenses such as rent will widely fluctuate depending on your situation and location. Plus goods, restaurants and food prices will range across the different London Boroughs. By keeping this in mind, there is scope for savings on most parts of your monthly costs.

Why is London so expensive compared to the rest of the UK?

Now, to answer the question we're all wondering - why is London so expensive?

Firstly, the cost of rent is the biggest factor to consider. We've taken the average price of a one bedroom flat for our calculations in this section, which amounts to as much as 60% of the total monthly living costs. Although your living situation may be different, rent or mortgage costs will be a huge chunk of your monthly outgoing while in London.

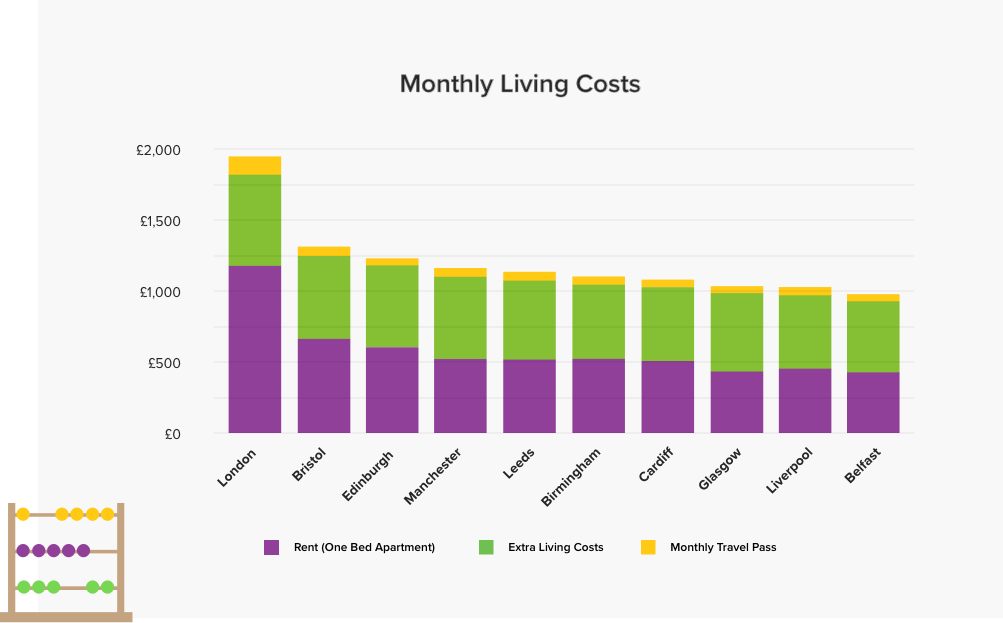

The main reason London is so expensive is housing. In fact, average monthly rent is more than double the cost of a range of UK cities such as Cardiff, Birmingham and Manchester.

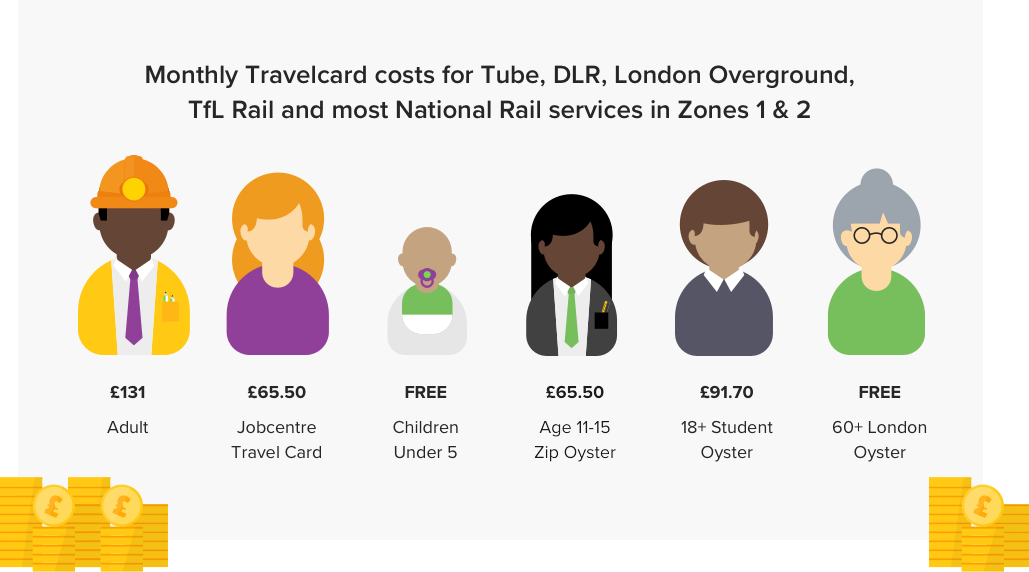

Transport costs also dwarf the rest of the major UK cities, with a travel pass costing £131 for Zone 1 and 2. This makes it the most expensive city travel pass in the world according to Numbeo. Compared to the £55 for a monthly travel pass in Belfast, £66 in Bristol, and £54 in Edinburgh, this is an aspect of London living that will take a sizeable chunk out of your monthly wage.

Save on your move to London

Get your free quotes and save up to 70% today!

Compare the cost of everyday living in London

Apart from rent and transport costs, day to day living in London is expensive but manageable when compared to the rest of the UK.

For example, the average Londoner will spend around £643 a month on food, bills and leisure, compared to £584 a month for the average Bristolian and £575 in Edinburgh.

The average monthly grocery shop in London is nearly 20% more expensive than cities such as Birmingham, but is actually cheaper than Edinburgh.

Shopping in smaller food stores while in the capital may incur a higher cost. However with a huge range of markets and stalls offering a spectrum of world foods, you'll be able to cook a range of meals on a budget.

At £5, an average London pint is more expensive than most UK cities, but as in every city there are cheaper places to socialise. At an average of £14.99, an inexpensive restaurant meal in London is around £5 more than a city such as Cardiff, but is only around 50p pricier than a similar meal in Edinburgh. With such a huge range of eateries in London, it won't be difficult to go for the odd meal that fits within your budget.

Plus, when you factor in the higher average London wage, the disparity between the cost of food and restaurants across major UK cities is lightened.

Income and cost of living in London

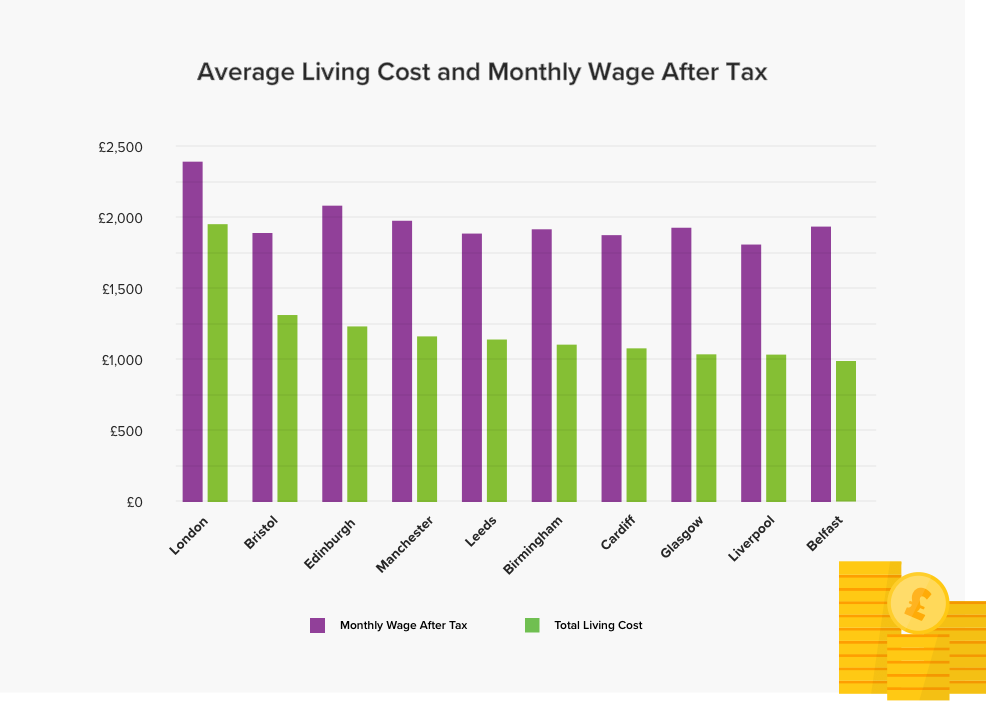

Now, for some good news. You'll be earning more in London than any other UK city.

The average London wage (according to the latest Government figures) totals £2,390 a month after tax. In comparison, the average person is bringing back £1,889 a month after tax in Bristol, and £2,081 in Edinburgh.

Overall, the average wage in London is 29% higher than in Birmingham, 24% higher than in Manchester, and 28% higher than in Glasgow.

In London the cost of living is closer to the average monthly wage than many other major UK city, but there is still some room to breath month to month.

By our calculations, if you're earning the average London wage, you'll be left with £439 expendable income after rent, bills, travel and living costs are all paid.

| Expendable Income After Living Costs | |

|---|---|

| £439 | London |

| £576 | Bristol |

| £744 | Leeds |

| £773 | Liverpool |

| £795 | Cardiff |

| £810 | Birmingham |

| £812 | Manchester |

| £848 | Edinburgh |

| £889 | Glasgow |

| £947 | Belfast |

Compare London house removals costs

Expendable income calculated from 2017 Annual Survey of Hours and Earnings report

In contrast, the average Bristolian has £576 in expendable income left at the end of each month, and those living in Cardiff and Belfast have £795 and £945 respectively.

Although you may be worse off than other major UK cities, London is survivable on the average wage.

Once again, the rent proportion of our calculations for this chapter is for a one bedroom flat at £1,177. So if you live in a flatshare with a lower monthly rent, you'll be able to increase that expendable income, with more scope to save.

How to save money when living in London

It is possible to save money and enjoy living in London.

By planning your finances and cutting down the huge cost of renting through options such as a flatshare, you can enjoy a good quality of life in the capital.

The top tip is to plan ahead in all aspects, starting before your move to London.

- Prior to your move, work out your wage to rent ratio if you have a job lined up.

- Work out what you need for food, travel, everyday goods and general emergencies.

- Add utilities, council tax, phone bills and gym membership, overestimating the monthly cost.

- Set up a monthly payment into a savings account with any remaining part of your wage.

Money saving tips in London:

- Keep an eye out for offers, and also concentrate on free activities like museums.

- Avoid owning a car. London has extremely well-connected public transport.

- Preparation is key - simple things add up in the long run. Plan and prep your meals for the week, share a food shop with housemates and book things in advance.

- Offset the cost of a mortgage by renting out a section of your property. Having a lodger in a spare room is a great way to trim the cost of your monthly payments.

- Avoid taxis, use public transport instead (or better yet, cycle!)

- Live in a flatshare.

London is famous for its high cost of living, which can be a daunting prospect for someone planning to move to the capital.

But this chapter demonstrates that with higher average wages, much of this cost is softened. The pain points are the sky-high rents and steep travel costs, but now that you know this you can plan ahead and budget. London can be expensive, but the experience of living in the city makes the money drain worth it.

Renting in London

The average cost of renting one room in London is £737 a month according to the latest SpareRoom Rental Index.

As the average for a bedroom in a flatshare, you can start to see how a large chunk of your monthly wage will be spent on your living situation.

In this chapter we explore the price of renting throughout London, and highlight some hidden costs you'll need to keep in mind when budgeting. We've also compiled some handy tips to help you rent in London.

Cost of renting in London

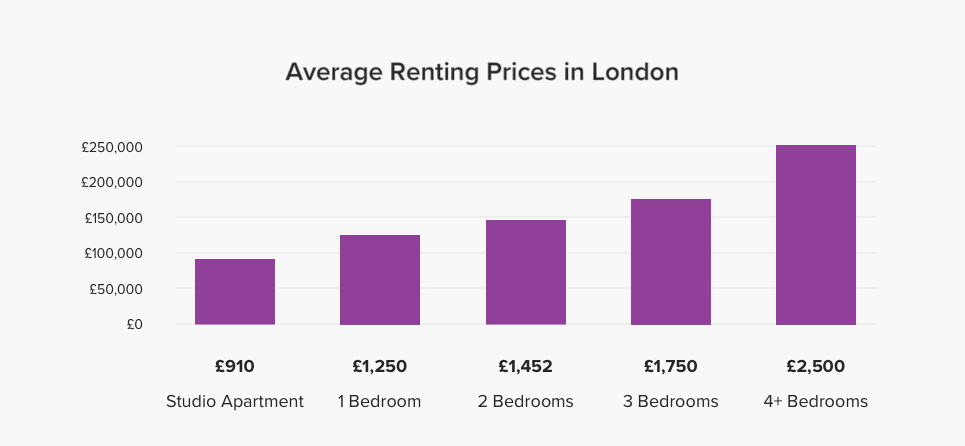

As for whole flats and homes, here's a rundown of the latest UK government figures on renting across London:

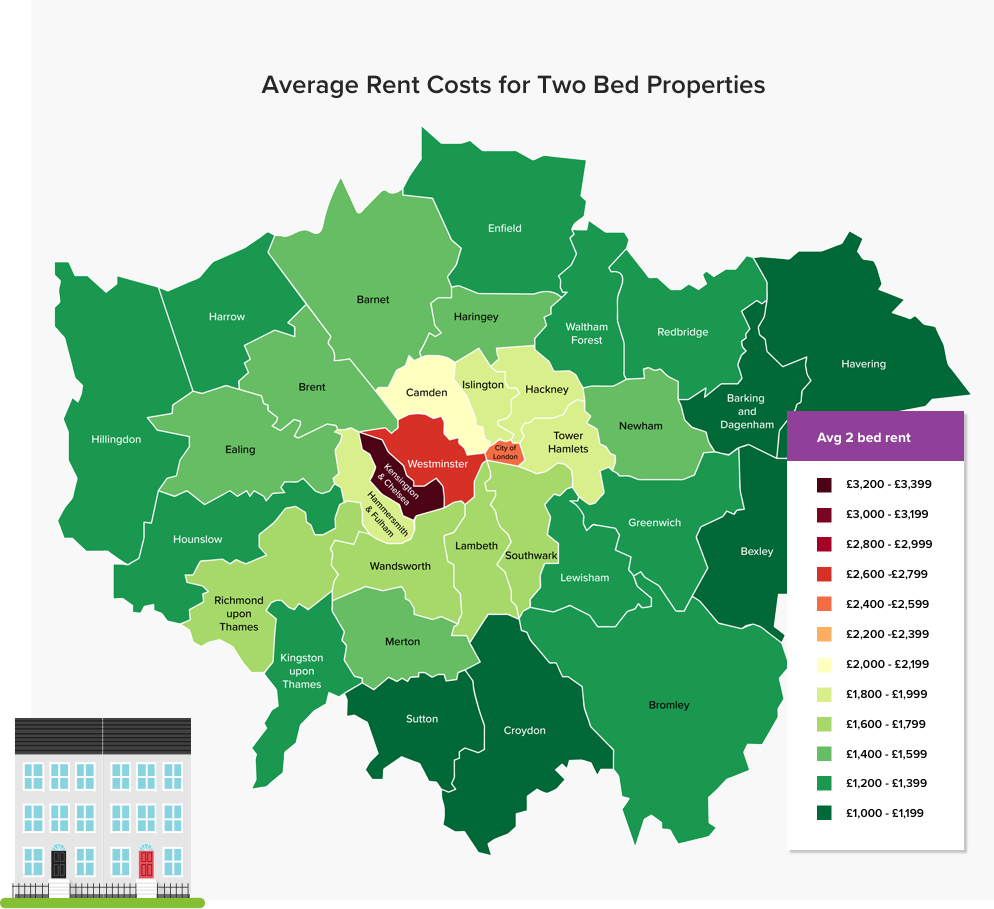

This is of course an average across the capital, so it's worth noting that rent varies substantially depending on the area. Generally, expect to pay more the closer you live to the centre and major commuter lines.

For example, the cheapest borough for renting a two bedroom apartment is Bexley in South East London at £1,050 a month on average. Compare this to the central borough of Westminster, where the average two bedroom rent is £2,330, and you can start to see the general picture of renting in the capital.

Average rents for studio apartments in Outer London Boroughs like Bexley, Havering, Hillingdon and Croydon are all on average below £750 a month. In contrast a studio apartment in the City of London costs on average £1,950.

Renting in London is a bit of a balancing act, between quality of house and quality of surrounding area. Do you pay extra for living central, or do you pay extra to commute?

Save on your move to London

Get your free quotes and save up to 70% today!

Remember to budget bills

It's worth taking into account the whole range of costs involved because realistically, the actual rent paid isn't the only cost you'll face.

You'll need to remember to budget in utility costs including council tax too. Although council tax varies by band across the 33 boroughs, expect to add at least an extra £120 on top of your monthly rent.

Energy providers Ovo Energy puts utilities for a medium house at £1,153 a year, so add about £96 as a household a month to the bill.

The cost of securing your rental in London

All in all, it may cost you around £2,560 upfront to secure your average London studio.

The upfront costs of securing an average studio apartment in London is broken down as follows:

- The first month's rent upfront: £910.

- 6 weeks rent as a deposit: £1,260.

- Estate agent fees including tenancy agreement and reference administration: £390.

This will act as a guide to the kind of costs you may face, but remember that estate agency fees and rent will vary, so always check on the costs involved.

Compare the best moving companies

Enter your postcode and start comparing today

Check your contract for hidden fees

Finally, remember there will likely be a range of additional costs to consider throughout the tenancy, such as late rent fees (£40) and amendments to the contract (£150).

You won't escape extra costs when approaching the end of your tenancy either, as you can expect a £120 fee to renew your contract, or a checkout cost of £120. Always check your contract for these extra costs.

You can now understand why renting is an expensive business in London. Note that all cost averages were taken from Generation Rent's letting fees portal.

“Letting agent fees vary hugely, so it is worth checking when you're house hunting what you're likely to be charged on each property. If you're short on cash, you don't want to pick a flat with a slightly lower rent only to find yourself stuck with fees you didn't expect. Agents are required by law to display their fees tariff clearly, in branch and online – so if there's no sign of this, chances are they're cutting corners elsewhere.” Dan Wilson @ Generation Rent

Top tips for renting in London

1 - Plan Ahead

Sit down ahead of your move and break down all of your costs, including how much you'll budget for food, travel, entertainment and emergencies. Remember to add council tax and utility bills to your rent estimation (unless you get an all-inclusive place). Finally, make sure you plan for the potential of a lump sum in the form of estate agency fees.

2 - Be precise

Before you start your search, have in mind exactly what you want. Whether you go through an estate agent or a private landlord, you should communicate clearly what you're looking for. Be prepared to give details of how much you're willing to spend, your preferred area, how many people you want to share with and any specific local facilities. Set yourself a budget of what you can comfortably afford.

3 - Tenancy Deposit Scheme

At the start of your tenancy, you will be required to pay a deposit. Before you hand over any money, it's vital you have evidence that the landlord has set up a tenancy deposit scheme (TDS). This will ensure that the landlord can't scam you out of any money when it comes to getting the deposit back.

4 - Document everything

Take photos of EVERYTHING. As soon as you arrive at your property, take photographs to show the condition of the furniture, walls, carpets and mattresses. This is in case the landlord tries to claim that it was your fault that something is broken when it comes to the end of your tenancy. Your landlord should give you a detailed inventory where you can document any damage - if they haven't made you aware of it, ask for it!

You should never pay rent with cash as this isn't a sufficient enough receipt of payment. Keep note of every months rent with your bank statements which should be kept together in a safe place.

5 - Be smart

Like every capital city, it's always considerably more expensive to live right in the centre. There are affordable locations in the outskirts of the centre of London, though these areas will come with a longer commute.

If you're lucky enough to have any friends or family in London, it could be worthwhile to have a “trial period” and crash at their house whilst you work out which area is best for you. Alternatively, you could try a few Airbnb's as you find your feet.

6 - Know your rights

You should always know your rights as a tenant, therefore it's essential you thoroughly read your contract to know exactly what you're signing. Yes, we know it's long and boring, but you could easily skim read important information about hidden costs that you didn't know about. Make extra copies of your contract in case you misplace it. Alternatively, you can scan the contract giving you a digital copy as well.

Multiply your weeks rent by 52 weeks of the year and then divide this by 12 for each month. This should be a more accurate expectation of your rent price.

Moving house and want to save?

Compare and save up to 70% on removal costs

How to save money when renting in London

- Living in a ground floor flat in London is often cheaper.

- If you're renting with your other half, it's a good idea to split the rent on a single room.

- The cheapest boroughs to rent are Bexley, Havering, Barking and Dagenham, Sutton and Bromley.

- The more people you share with, the cheaper the rent is.

Though expensive, renting a house or flat in London is easily done. London has the highest rent in the UK, but as long as you work in any additional costs and be prepared in terms of the cost, then it'll be a breeze.

The renting market is extremely fast moving in London, but if you take the time to plan and find what's affordable for your budget, you'll find it'll pay off in the long run.

Buying in London

The latest UK Government figures puts the average property price in London at £471,986. This is more than double the UK average of £225,047.

House costs fluctuate across the capital, but it's worth noting that every borough of London has an average house price higher than the UK. So your options for buying a house in the capital will be expensive.

Cost of buying a house in London

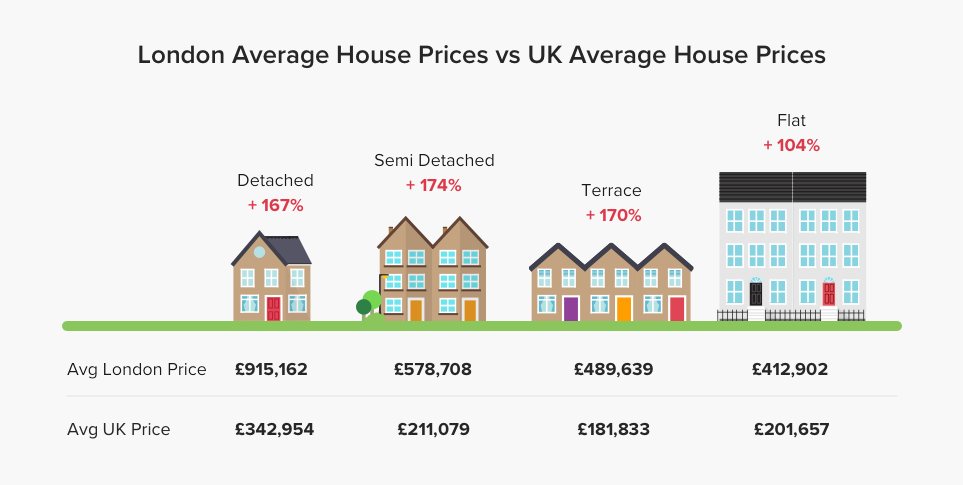

All house types in London are pricier than their equivalent across the UK, though some are more expensive than others. The most expensive London house type are detached houses, which on average costs £912,162, 167% more than the UK average.

Semi detached and terraced houses in London are less pricey on average at £578,708 and £489,639 respectively, but are still around 170% more than the UK average.

Finally, the average flat in London will set you back £412,902, which is nearly double the UK average. This is across London however, with some very affluent areas driving up the overall average.

It's worth keeping in mind the extra fees involved in buying a house in London. Alongside the deposit and overall house price, you'll pay extra fees including Stamp Duty and conveyancing amounting to £14,769.

| Extra fees to consider when buying the average house in London (£412,902) | ||

|---|---|---|

| £400 | Homebuyers Survey | Compare now |

| £770 | Conveyancing | Compare now |

| £13,599 | Stamp Duty | |

| £14,769 | Total extra fees | |

How much will it cost to buy in London

Calculate nowWhere to buy in London?

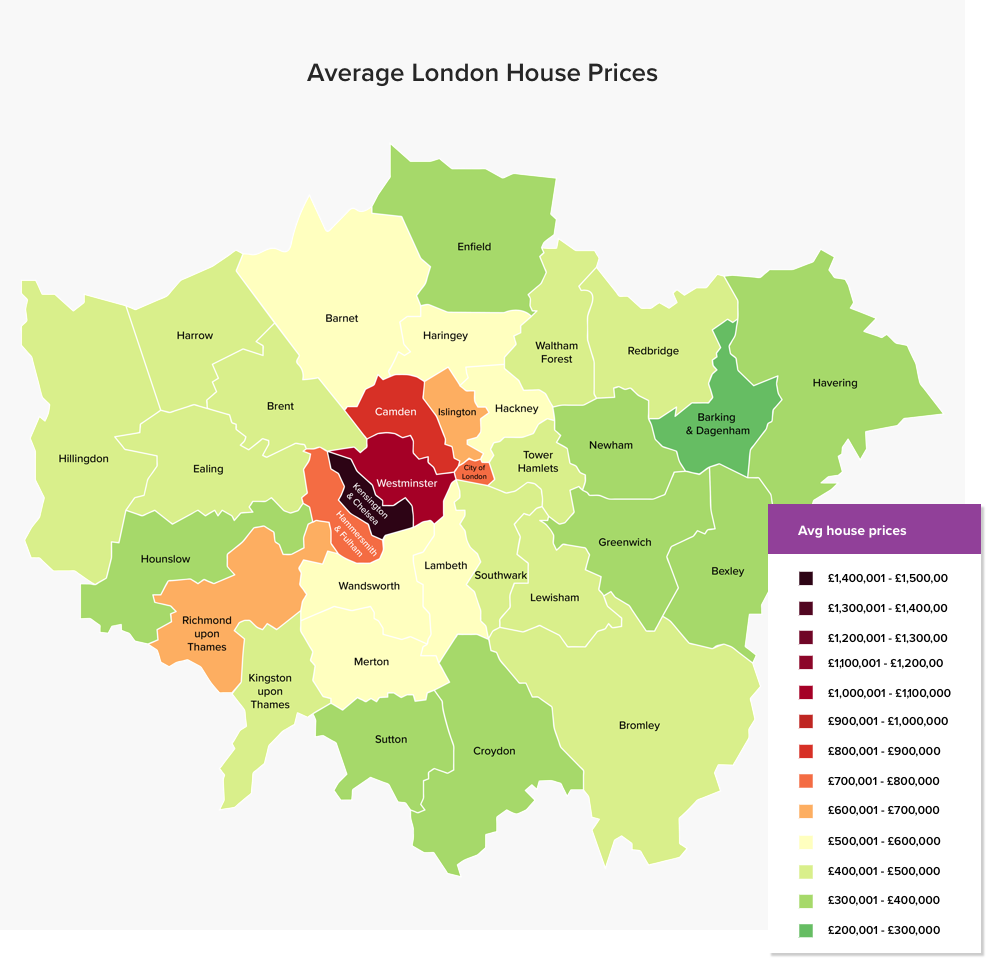

Average house prices in Outer London are nearly £150,000 less than the average house prices in Inner London.

The golden rule when buying in London is generally, the closer to the centre you are, the more expensive property will be.

The most expensive borough is Kensington and Chelsea, where the average property costs an eye watering £1.4 million. At the other end of the spectrum is Barking and Dagenham, the borough with the cheapest average house price of £293,180.

When searching for a house in London, you'll want to figure out a clear commuting line to your place of work; a cheaper flat may not be worth it if it's going to take you 2 hours to commute across the city every morning.

Buying in London is a juggling act between price, area, and transport connections.

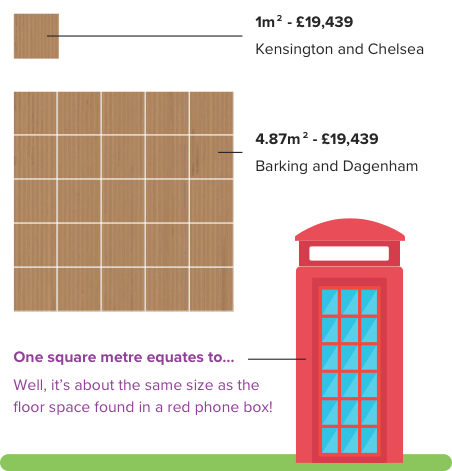

Another consideration when looking to purchase a house in London is house space. If we take the most extreme example, on average every 1m2 of property in Kensington and Chelsea costs £19,439. For the same amount of money you can get 4.87m2 of property in Barking and Dagenham. House space is a key consideration when looking for a place to buy in London, as you could be emerging from years of renting in a flatshare.

If you're an existing homeowner elsewhere in the UK, you'll likely have to factor in a downgrade in terms of size of house.

Cheap boroughs to buy a house in London 2018

Prices from Rightmove May 2018

Compare the best moving companies

Enter your postcode and start comparing today

Why are homes in London so expensive?

London houses are expensive, and sadly a higher property cost isn't fully softened by the higher than average wages in London.

By our calculations, the average London house price is more than 13 times the average London wage. This is compared to the average UK house price being 8 times the average UK wage.

Even with generally better wages across the capital, you can see you'll have a much harder job of purchasing a house in London. Especially as with a high cost of living and rent, it's very difficult for Londoners to save enough for the initial deposit - considering that a 10% mortgage deposit would be £47,199 for the average London house.

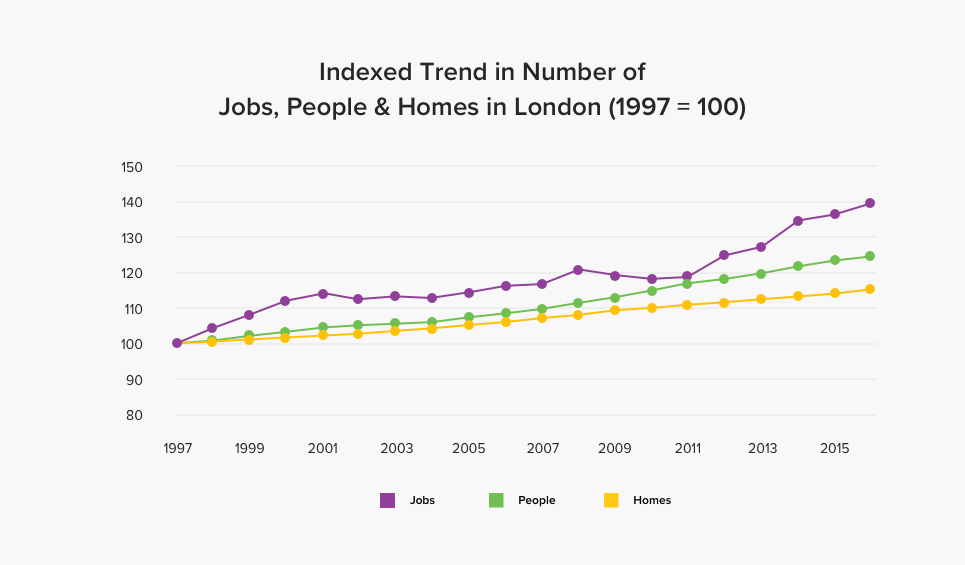

Supply and demand in London

A large part of why London houses are so expensive comes down to demand. According to the latest data from the Greater London Authority, over the last 20 years the number of people in London has grown by 25%, whereas the housing stock grew by only 15% over this period.

That's a population growth of 1.7m people, matched by an increase of only 470,000 homes. This trend is not getting better either, as over the last 5 years the number of homes increased by 4%, compared to a 7% population growth.

There's some good news however, as a new housing strategy has been introduced by the Mayor of London which aims to tackle rising house prices over the next few years by significantly increasing the amount of homes being built in London. The drive has a major focus on building affordable houses for Londoners.

Tips for buying a house in London

1 - Don't rush

Never feel pressured to buy the first house that comes up, however cheap it is. Take your time and do your research to find out exactly what you're looking for. Check the house for damp, cracks and anything that could be hidden under rugs or mats before making any offers.

2 - House auctions

Buying at auction is a great way to bag yourself a bargain. Not many people buy their houses via auction, so you have more of a chance of finding a real gem. Although most properties for sale at auction can often need some TLC, look at it as a fun project. Sit in on an auction to get some practice before the real thing.

3 - Get a Chartered Surveyor

Don't underestimate the importance of having your house surveyed. A Chartered Surveyor will carry out an in-depth report, highlighting any defects or repairs that could crop up later in the process. By getting a survey done on your property, you're ultimately saving money in the long run. Find out more here.

4 - Negotiate

Don't be afraid to haggle on the asking price. Once you've factored in the additional fees such as house removal and Stamp Duty, you'll want to bring down the asking price as much as you can. Valid explanations for a lower offer include extra costs to fix any damage, or if other houses in the same street are considerably cheaper.

Compare house removals

Get your free quotes and save up to 70% today!

Money saving tips when buying in London

- Make your opening offer 10% lower than the asking price.

- Sublet a spare room to counteract your mortgage costs.

- If any friends or family offer you free accommodation whilst you find your feet, take it!

- Look into services such as Airbnb to ease the cost of your monthly mortgage

- Sell your house before you buy. It may sound obvious, but it's easy to get carried away if you find the perfect property before you have a buyer.

- Get to know the seller. Call them if you have any queries or just want an update. If they know you personally it'll often work in your favour.

Purchasing a house in London may seem like a distant pipedream in this current climate, but this chapter highlights how although difficult, becoming a homeowner in London is possible.

You'll likely have to accept a downgrade if you're an existing homeowner across the UK, but with a huge sense of community in different areas of London, the London lifestyle will reward the hardships of being a homeowner.

First Time Buyers in London

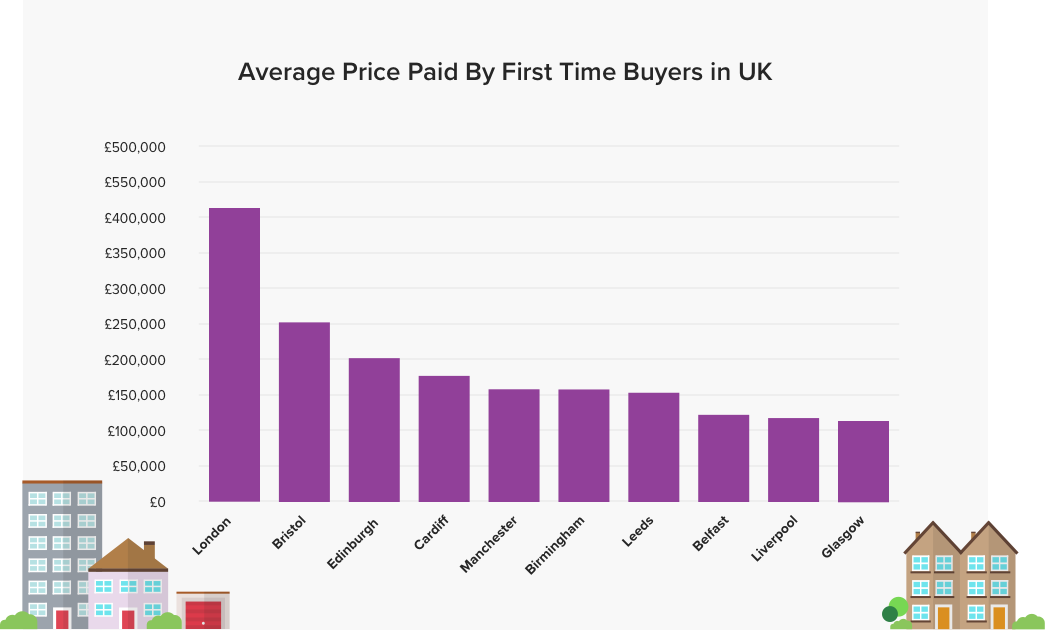

First time buyers in London will have to pay £412,482 on average for their first house, according to the latest housing data (UK House Price Index).

This is more than double the average across Great Britain (£189,584). Suffice to say, first time buyers in London have a hard task ahead of them. Although difficult, buying your first property in London is not impossible.

London housing is expensive for the average first time buyer, costing 11 times the average London wage.

This is compared to the average British first time buyer, whose first house costs 6.5 times the national average wage.

The cost of your first house is more than double the amount in many other major cities, with first time buyers in Edinburgh, Cardiff and Manchester paying on average £202,027, £177,147, and £158,308 respectively.

Although expensive, it's worth noting that the price does vary across the London boroughs, with many of the more expensive central London areas driving up the average.

The most affordable borough for first time buyers in London is Barking and Dagenham at £277,981, which is only £25k more than what Bristolian first time buyers are paying on average. You can see that some areas are more in line with what other buyers are paying in popular areas across the UK.

Prices also fluctuate in different areas within London boroughs, so it is possible to find homes for much less than the London average.

The golden rule that house prices rise as you move towards central London is also true for first time buyers, with Inner London and Outer London costing £513,036 and £365,978 respectively for the average first time buyer.

Compare the cost of moving to London

Get your free quotes and save up to 70% today!

How much is a first time buyers deposit in London?

Alongside the ongoing cost of a mortgage, one of the hardest parts of the house buying process tends to be saving up for a deposit.

Londoners looking to get on the property ladder will have to save more than £40,000 for a 10% deposit on the average property in the capital. A 10% mortgage deposit is recommended to get a manageable rate on your mortgage.

In the cheapest borough for first time buyers, Barking and Dagenham, a 10% deposit would therefore set you back £27,798.

The minimum 5% mortgage deposit would still set you back £13,899 in Barking and Dagenham, and just over £20,000 for the London average. In sought-after boroughs such as Camden, the average first time buyer will have to raise £34,751 for a 5% deposit.

Although at least a 10% deposit is recommended, the 5% figure is important as it is the minimum amount needed for the London Help to Buy scheme.

To work out exactly how much of a deposit you need for every London borough, use our house deposit calculator below.

London house deposit calculator

The mortgage deposit you can expect to pay as an average first time buyer in each London borough.

Average house prices taken from UK House Price Index February 2018

Saving for a deposit in London

With extortionately high rents, it's difficult to see how a first time buyer can afford to save the more than £40,000 needed for a 10% deposit on a mortgage.

Luckily, there are two saving schemes which offer first time buyers a 25% boost to their savings courtesy of the UK Government.

1 - Help to Buy ISA

The Help to Buy ISA can be used towards a property below £450,000 in London.

You can pay up to £200 a month into the ISA, and can deposit up to £1,000 to begin the ISA. When the amount is used towards your house, you'll receive a 25% bonus on your savings of up to £3,000. Although you can only have one ISA open, if you're looking to buy a home with a partner, you can both use the scheme in conjunction.

The ability to join the scheme ends on 30th November 2019. It's worth keeping in mind that you'll only receive the bonus if it's used towards the mortgage deposit.

2 - Lifetime ISA

A relatively new saving scheme, the Lifetime ISA can be used towards a house priced less than £450,000.

You'll be able to deposit up to £4,000 a tax year into the ISA, and will receive a 25% government bonus paid directly into the account at the end of each month.

The savings can be used towards both the exchange and mortgage deposits, and much like the Lifetime ISA can be used in conjunction with partners using the same scheme. There is a scope for a larger Government bonus than the Lifetime ISA, and the bonus actually sits in your account accruing interest.

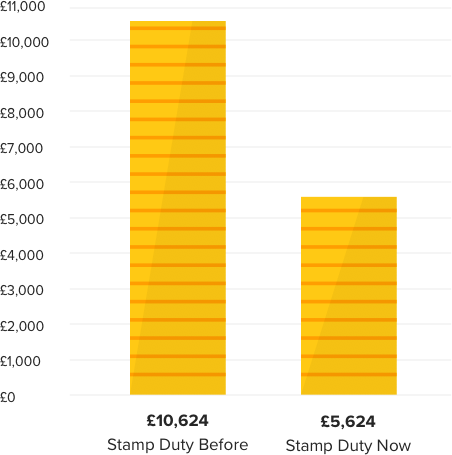

Stamp Duty changes in London

Some government changes have helped to lighten the load for first time buyers.

Changes in 2017 to Stamp Duty means first time buyers in England won't pay Stamp Duty on properties up to £300,000. Therefore, the average first time buyer in London will have to pay £5,624 in Stamp Duty in 2018, compared to the £10,624 bill prior to the new law.

This is good news for first time buyers, with the average first time buyer in areas such as Croydon seeing a saving of £5,000 off their stamp duty bill (average first time buyer house price £311,287).

The average first time buyer in Barking and Dagenham won't pay Stamp Duty, saving them £3,899. Although this may be dwarfed by huge deposits, savings certainly help when every penny counts.

You can stay on top of extra costs such as Stamp Duty by using our Cost of Moving House Calculator.

Schemes to help first time buyers in London

Buying your first house in London is possible!

There are a range of government schemes available that can help first time and existing buyers alike get on the property ladder in London. Let's have a look at your options.

Shared Ownership in London

Shared Ownership helps those who can't afford the total cost of a house get on the property ladder.

This government scheme allows you to buy a share (between 25% and 75%) of your house with the remaining portion being paid for through rent to a local housing authority. As you'll only need to get a mortgage for the share of the property you own, and with deposits as low as 5%, this drastically lowers the amount of money you need to get onto the property ladder.

Throughout the scheme you can increase your share up to 100%, and the rent you'll pay will be less than the price on the open market. To be eligible in the scheme in London you'll need to have a household income of less than £90,000, and must prove you cannot pay for a property outright.

Note that shared ownership houses are leasehold.

London Help to Buy

Through this scheme, you can get up to 40% of the property price of a new build home through a Government equity loan, which is interest free for the first five years.

This scheme gives you a better rate on your mortgage, meaning you'll only need a 5% deposit. You'll need to be a first time buyer or existing buyer looking to move, and must be purchasing a new build home less than £600,000. You'll need to pay back the loan when you sell your home or after 25 years.

Look for a local Help to Buy agent to find out more information.

Save on your move to London

Get your free quotes and save up to 70% today!

Best areas in London for first time buyers

Compare house removals

Get your free quotes and save up to 70% today!

Tips for first time buyers in London

- Try and pick a cheap up and coming area to live that has the potential to grow.

- Barking and Dagenham is the cheapest borough in London to live.

- Don't be afraid to seek help. The London Help to Buy Scheme allows you to pay a 5% deposit on your property.

- Changes to Stamp Duty in England means that first time buyers won't pay Stamp Duty on properties up to £300,000.

Once you know the cheapest areas for first time buyers and you're aware of the available help, buying a house in London may not seem so scary after all.

Though more difficult than elsewhere in the UK, purchasing your first property in London is possible with the right saving schemes and planning. Through government schemes, there is support to get your foot on the property ladder in the capital.

Working in London

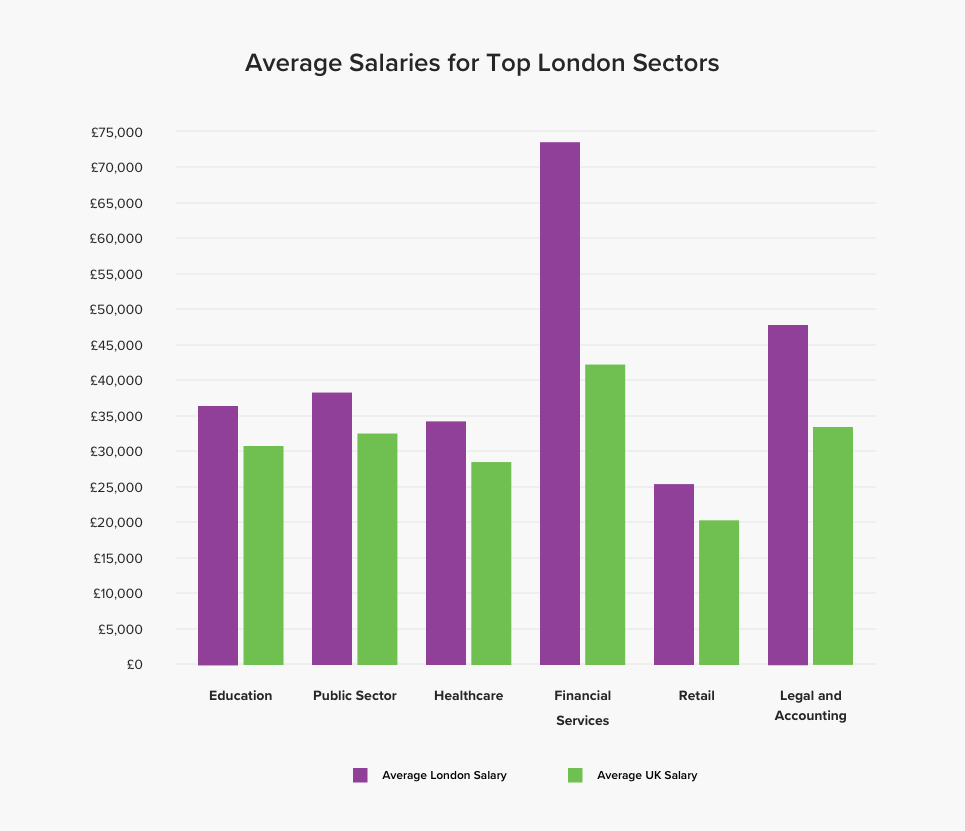

According to the latest UK government data, the average salary in London is £37,209, compared to the UK average of £28,758.

One of the major draws of London is employment. In a city with such a high living cost, where rent and house prices are well above the national average, you'll be happy to hear that wages are above the rest too.

With the financial centre acting as the city's beating heart, the sheer amount of roles on offer means it's truly a professional city. The latest employment figures highlight 5,836,000 full time jobs in London, so it's no wonder people flock to the city for employment.

Data taken from Annual Survey of Hours and Earnings (ASHE)

Top jobs in London

The top employment area in London is education, with the latest government estimates highlighting 281,000 workers across the city in the education sector.

If you're a teacher, know that you certainly won't be alone when you move to London. The next most popular jobs are in public administration and public health, with 187,000 and 176,000 workers employed in these sectors respectively.

Compare the best moving companies

Enter your postcode and start comparing today

Average salary in London

The latest survey of earnings puts the average salary for a full time job in London at £37,209, in contrast to the UK average of £28,758. This means that you could enjoy a wage increase of nearly £8,500 by moving to the capital.

Of course, wages differ across sectors and occupations within London. It's clear that across the board, regardless of the job title, the London wage is higher than the UK average.

Public health sector in London

If you're an NHS worker or a public health professional, you could earn nearly £6,000 more than the UK average if you were working in London. In the capital, the average wage in the healthcare sector is £31,170, compared to the UK average of £28,450. Public sector workers enjoy a similar wage boost, and as the second biggest employment sector in London earn £38,191 on average.

Education sector in London

Likewise, London teachers can expect to earn more than £5,500 above the UK average, as the average London wage for the education sector is £36,370.

If you're in education, healthcare or the public sector, moving to London may be a surefire way of boosting your wage.

Financial sector in London

Strengthening the city's reputation as a finance and banking hub of the UK and even the world, the financial sector is the 4th biggest employer in London.

Perhaps the biggest winners, workers in the financial sector can expect a huge wage boost in London. Financial workers earn £73,290 on average in London, a massive £32,450 above the the UK average for the sector. Likewise, legal professionals and accountants take home on average £47,699 in London, a £14,000 boost on the UK average in the sector. It's clear that for legal and financial professionals, moving to London could trigger a sizeable wage boost.

Retail sector in London

Wages are higher across the board, with retail workers taking home an average of £25,360 in the capital, £5,000 more than the UK average.

Moving house and want to save?

Compare and save up to 70% on removal costs

Where to work in London

You'll have a decent idea of your prefered working sector ahead of your move to London, so how will that change where you decide to live?

Whether it's finance, retail, transport or health, every borough has a dominant sector. It's worth keeping in mind where you'll work when planning to move to London, to minimise your commute.

Public health sector

If you work in the health sector, you're spoilt for choice across London with a range of major hospitals covering most boroughs. Health and social care is in fact the top employer in 13 of the 32 London boroughs across both Inner and Outer London. The borough of Lambeth has the biggest concentration in London, with 34,000 health and social workers based in the borough. St Thomas' Hospital is a huge teaching hospital for the NHS which is based in Lambeth.

Professional sector

Professionals workers such as accountants, scientific researchers and estate agents dominate the employment sector in 8 boroughs across London. By far the highest concentration of professionals going to work in the central London borough of Westminster, where 152,000 professionals are employed. The ultra-hip boroughs of Camden, Southwark and Islington follow, with a total of 180,000 professionals employed across these central boroughs.

Financial sector

Alongside professional services, the financial sector dominates central London. Tower Hamlets and the City of London have huge financial and insurance sectors, with 169,000 financial workers working in the City of London alone.

Transport and storage

The west London boroughs of Hillingdon and Hounslow have a majority of workers employed in the transport and storage, with 33,000 and 39,000 transport sector workers respectively. It's no surprise that Hillingdon is home of Heathrow Airport, and Hounslow is famous for its rail links.

Moving to London without a job

We've covered the costs of living, so travelling to London without a job lined up may not be the best of ideas. But like all risks, being well prepared will help you along the way.

Realistically you'll need savings as a buffer for your first few months, low expectations on what jobs you'll be able to get first, and an escape plan in place. With some determination and grit, it's possible to eke out a living in London with no plans from day one.

Tips for moving to London without a job

- Calculate how long you could last on your savings without getting a job, and remember to be realistic with your costs.

- Aim to find temp and immediate work, and be open to all job offers in your first few months. Find income while you figure out a permanent role.

- Try and arrange at least a few interviews ahead of your arrival, so you're not arriving completely blind.

- Immediately canvass the area you're living in for casual work to tide you over.

- Remember travel costs are huge, and the amount of money it costs to actually get your foot into a rented house is an eye watering lump sum.

- Got a network of friends? Take the risk and see if you can stay on their sofa while you get some work.

Save on your move to London

Get your free quotes and save up to 70% today!

How to find a job in London

1 - Plan ahead

Search for available jobs in the area that you're planning on moving to. It's even better if you can bag yourself a job before the move.

2 - Media, Design or Fashion

If you're in any of these sectors then the best areas to live are; Stoke Newington, Dalston, Soho and Hackney Central.

3 - Be realistic

Don't expect to land your dream job straight away. Go for any job you can, whilst you look for what's best for you. The more experience, the better.

4 - Be prepared

Make sure you have all the essential documents you need in order to not delay the process. Passport, identification, proof of address and your P45 form are usually needed.

5 - Young professionals

The most suitable areas for young professionals seeking work are; Kentish Town, Camden, Shoreditch, Battersea and Fulham. These areas offer employment opportunities as well as a lively social scene.

6 - Network

It'll always be beneficial to know people in the area of work you're interested in, whether via social media or a meetup group, it'll help you get a foot in the door.

7 - Stay up to date

Update your CV and LinkedIn profile regularly. Employers want to know if you can speak an additional language, this often gives you an advantage.

8 - Finance

The best areas for jobs in finance are; Isle of Dogs, Canary Wharf, Limehouse, Tower Bridge and Wapping.

Now that you're aware of which London borough is home to the top employment sectors, it should help you ease in to the process of finding a job.

If at first you fail to receive any interview invites, don't worry. There are 5,836,000 full time jobs in London, according to latest employment figures - AND with a higher wage than the rest of the UK, the hunt for a job suddenly seems not so bad.

Compare the cost of moving to London

Get your free quotes and save up to 70% today!

Living in London

There are more than 8.7 million people living in London according to the latest census, 13% of the entire UK population.

London is a world city, and it goes without saying that such a bustling hive of people will have unrivaled social scenes. Here we explore living in London as a student and with a family, provide tips on living alone, and highlight the best things to do when you're living in the city.

Living in London with a family

There's a lot to keep in mind when moving to a new house with your family, especially in a big city with a ton of options.

Where's the most family-friendly area to live? What are the best schools? What's the transport system like? Here are the best places to live in London if you're moving with a family.

West & Central London, Hillingdon

The borough of Hillingdon offers a variety of family friendly areas to reside in, with a great sense of community feel. Located 20 miles west of central London, Uxbridge is a suburban town with a picturesque canal-side setting and stunning period houses. Uxbridge proves to be a popular area for families, with a variety of respectable schools, reasonable house prices and easy accessible tube stations.

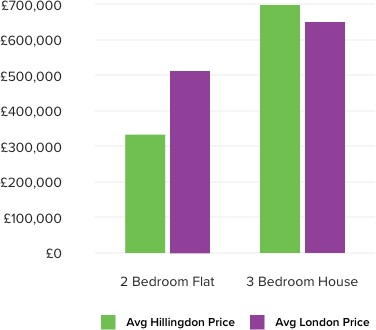

The average current asking price to buy a two-bedroom flat is £331,400, while a three-bedroom house averages at £510,459. This is significantly cheaper than the London average for a two-bedroom flat at £694,438, and three-bedroom house at £646,753.

The education system in Hillingdon is varied. There's St Matthew's CofE Primary School in West Drayton where 90% of pupils meet expectations. Likewise, Uxbridge High School has 91% of their students staying in education or entering employment after their time at the school.

Hillingdon is home to many parks and nature reserves that ensure your child can play in a safe and clean environment. Overlooking the Jacobean Swakeleys House, Swakeleys Park is surrounded by scenic greenery, lakes and tennis courts. The recent renovation has seen new playground equipment for the children's play area.

Uxbridge is on the Metropolitan and Piccadilly Tube lines with the station being Travelcard Zone 6.

South London, Sutton

Renowned for its notable sense of community, Sutton presents a great case for moving in as a family. It offers a mile-long high street with popular and affordable favourites such as Pizza Express, Zizzi and All Bar One. Alternatively, Sutton is home to a great range of independent eateries including Spaghetti Tree, Il Toscano, and Brasserie Vacherin.

Again, Sutton is a reasonably affordable area compared to the rest of London. You'll be looking at a current asking price of roughly £303,763 for a two-bedroom flat or £384,532 for a two-bedroom house.

Sutton has an impressive 89 parks in the borough. Morden Hall Park has a lot to offer for families during summer including guided history tours, dog walking and kids' clubs. This summer sees Morden Hall Park play host to The Luna Cinema screening child friendly films.

The borough offers parents a variety of Ofsted excellent schools for your children. Primary schools such as St Mary's RC Junior School and Barrow Hedges Primary School are voted the top in the area. Glenthorne High School and St Philomela's School are amongst the more credible secondary schools in Sutton.

Sutton is served by Southern and Thameslink trains, and can be found using Travelcard Zone 5.

Greater London, Bromley

Not only is it classed as one of the safest areas in South East London, Bromley is also renowned for its consistency in maintaining a family friendly vibe in the area.

Property-wise, the average current asking price for a three-bedroom flat in Bromley is £441,599. A three-bedroom house is £505,999. The price of a one-bedroom flat averages at roughly £261,939.

Bromley's education sector has a lot to offer. Some of the best primary schools in the area are Harris Primary Academy Shortlands and Alexandra Infant School. In terms of secondary schools, St Olave's and St Saviour's Grammar School and Hayes School rank the highest in terms of student progression after education.

Bromley offers several open spaces and parks. Voted the top day out in Bromley on TripAdvisor, High Elms Country Park is the ideal venue for a picnic with the family.

Bromley is Travelcard Zone 4, operated by Southeastern.

House prices from Zoopla May 2018

How much will it cost to buy in London

Calculate nowLiving in London as a student

In this section we highlight a few of the popular universities in London, league table statistics and affordable areas nearby to live off campus.

Queen Mary University of London (QMUL)

Russell Group member Queen Mary University of London can be found in the culturally diverse and artsy area of East London, Mile End. Ranked 98th in the 'Times Higher Education World Rankings' in 2015, Queen Mary has been globally acknowledged for brilliance in the following subject areas; Business, Economics, Finance and Management, Humanities and Social Sciences.

The cheapest option in halls is a single small room in the university's Whitechapel accommodation, priced at £128.24 per week and the most expensive being in a Stratford single studio at £199.99 weekly. However, the most popular choice would be accommodation in Mile End. For a single standard, shared bathroom between three-six residents, The Albert Stern House would be £132.09 a week.

Alternatively, a lot of students chose to live off campus in their first year as well as in their second and third years. Mile End Road is a popular area for students as the location is nicely situated near campus, at an affordable price. An average price of weekly rent for a three-bedroom property can range from £450 to £600.

Prices from Queen Mary University website

Data from The Complete University Guide 'League Ranking Scores': accessed May 2018

Goldsmith University of London

Ranked one of the most creative universities in the UK, Goldsmith University of London is located in New Cross, an area The New York Times classed as a 'hub of creative talent.'

Goldsmith subjects of excellence include; Sociology and Anthropology, Media and Communications, Computing, Politics and International Studies and Psychology.

They offer a variety of locations for student accommodation with the cheapest being Surrey House. Only a 5-minute walk from campus, this shared accommodation is priced at £139.58 a week. Dean House halls will cost you between £142 to £145 a week for a private bathroom and shared kitchen. McMillan Student Village weekly price is £160.50.

A favourite area amongst students to live off campus is Brockley. Lots of students chose to stay around Brockley after graduating because of the community feel and affordability. Browns of Brockley and the street food at the Bromley Market attract locals regularly. For a three-bedroom flat, the weekly rent would average between £450 and £669.

Prices from Goldsmith University of London website

Data from The Complete University Guide 'League Ranking Scores': accessed May 2018

Royal Holloway University of London

Renowned for its excellence in Arts and Humanities, Royal Holloway ranks as one of the best research focused universities in the UK. Located just 19 miles from the centre of London, Royal Holloway is home to one of the world's most beautiful campuses. The university prides itself on its culturally diverse students and its brilliance in the Sciences, Social Sciences and Management and Economics.

The cheapest accommodation they offer is £80.48 a week in 'Kingswood 1'. This is a shared room, but a catering service is included in the price. Kingswood 2 is a single en suite with catering for £141.15 a week. The most expensive option in Royal Holloway halls is the Butler Gowar Tuke Wedderburn Williamson halls which will cost you £168.90 a week for 38 weeks.

A popular off campus area to live is Egham. Weekly rent for a three-bedroom house ranges from £350 to £600.

Prices from Royal Holloway University website

Data from The Complete University Guide 'League Ranking Scores': accessed May 2018

Top 5 universities in London

Imperial College London takes the crown as the 3rd best university nationwide AND ranked 8th in the world. Coming in at 5th favourite in London and 14th in the nation is Queen Mary University of London. It's renowned for its excellence in subjects such as Business, Economics, Finance and Management, Humanities and Social Sciences. The table below shows the 5 best universities in London and their nation and global ranking.

| Universities in London with UK and Global Rankings 2018 | ||

|---|---|---|

| UK rank | Global Rank | University |

| 3 | 8 | Imperial College London |

| 4 | 16 | University College London |

| 5 | 25 | London School of Economics and Political Science |

| 7 | 36 | King's College London |

| 14 | 121 | Queen Mary University of London |

Rankings from The Times Higher Education World University Rankings 2018: accessed May 2018

Compare the best moving companies

Enter your postcode and start comparing today

Living in London alone

By living alone, you get the opportunity to develop a great sense of freedom and independence.

Whether you're moving to London to pursue a career or start afresh, it's important to be savvy when it comes to finding somewhere to live alone. We understand it can seem extremely daunting, so we've compiled some handy things to know if you're making the move on your own.

Renting alone in London

- Renting a single room in a shared house will help kickstart your new social circle.

- Some of the cheapest areas for living alone are Bexley, Sutton, Croydon and Havering.

- Temporary accommodation will give you time to make sure the area you're moving to is right for you.

- Finding a room in a houseshare will be cheaper than renting somewhere entirely on your own.

Find a balance

- If you're moving to London on your own for work, then you don't want to move too far away from your friends and family.

- It's very important to find the balance of being close enough to work but also within reach of friends and activities outside of work.

- Do your research and figure out the best area for you, with a reasonable commute both to work and back home to friends and family.

- Once you've found a job and an area that is suited to you, London gets more and more exciting as you start to build a new life for yourself.

Enjoy the change, London is full of opportunities!

- Enjoy it and don't get bogged down in the stigma that comes with doing things solo.

- The versatility of London means that it's somewhere that can be explored by yourself or with friends.

- Don't be afraid to strike up a conservation with someone in any walk of life, you never know if you have something in common with someone until you speak to them.

- Don't worry about going to a show or a gig on your own, by doing things you are interested in then you will inevitably meet more people.

Compare house removals

Get your free quotes and save up to 70% today!

How to meet new people in London

Packing up and moving to London from any location is a big deal.

Whether you're moving alone, with friends, or as a couple, it's important to be aware of the best ways to meet new people and socialize. Follow some of our tips to help settle in and find your groove.

Exercise

London has a huge variety of beautiful parks with lots of like-minded people wanting to keep fit but also make new friends. Try joining a running or cycling group - it's a great way to exercise whilst socialising at the same time. Alternatively, you could join Project Awesome - a free exercise class with a twist. Monday, Wednesday and Friday they take to the streets of London offering a unique and fun-loving work out session. Expect 'badass workouts' and lots of bright colours to motivate you.

Socials

There are some amazing websites designed specifically to meet new mates. Check out Citysocializer if you want an authentic experience of London's social life, whilst making some friends along the way. They truly offer something for everyone to get stuck in to, with a range of activities from theatre and art museums, walking tours and cinema trips to cocktail classes, Sunday lunches and clubbing.

Local pub

The best way to get to know people is finding your local pub. You can always count on the pub hosting a weekly quiz or a themed evening sampling new beers or food. There's no greater sense of community than in the local pub, whether it's for a cup of tea with your elderly neighbour or just getting some alone time with your new book, you'll always feel welcome.

Meetups

Meetups is an innovative website that gives you the opportunity to meet like minded families in London. Recent meetup groups have included a variety of specific people looking to share their experience of parenting and socialise such as; 'French speaking mums', 'gay parenting through surrogacy' and 'Greenwich dads'. Similarly, there will be local Facebook groups offering the same sort of support.

Save on your move to London

Get your free quotes and save up to 70% today!

London lifestyle tips

If you've just moved to the big city you'll want to get involved with the varied social scene.

We've compiled some tips to help you find your way around town, including supper clubs, must-sees, and the best things to do on a budget.

Things to do in London

Eating and drinking in London

Hidden gems of London's social scene

This chapter highlights some cheap and creative areas to live in London, whether you're going it alone or moving there with your family.

Whether you're living in university halls, alone or with your partner, London offers something that everyone can appreciate.

Transport in London

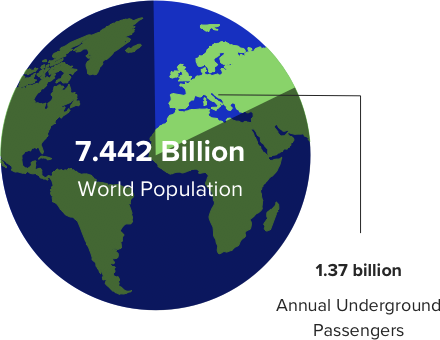

With 1.37 billion trips taken on the London Underground every year, this is a city which is always on the move.

The transport system may seem complex, but luckily we're here to explore your options for getting from A to B in London.

Using Oyster Cards and contactless payments in London

The good news is that London's major public transport systems are all integrated, meaning one payment system across the differing networks. Introducing, the famous Oyster card.

This plastic card can hold pay as you go credit, travel cards, season tickets and monthly passes, and can be used with all major public transport in London.

DID YOU KNOW The equivalent of 18% of the world's population rides the tube every year!

Data from TfL 'Facts & figures: accessed May 2018

The card can be topped up on the many machines that can be found dotted around the stations, or in dedicated Oyster Card shops. To pay your fare, you tap it going in and out of stations or on and off buses. Fares are capped, meaning through this system you won't be overcharged. Oyster Cards cost £5 in deposit, which you get back if you return it.

As well as the Oyster Card, you can use your own contactless payment card in the same way, or even your phone if you have contactless payments set up. Gone are the days of fumbling for spare change.

TOP TIP Remember to tap in and out. Always remember to use the same card!

Tube and trains in London

Although tackling the tube may be daunting, especially during rush hour, but as a Londoner you'll quickly get used to them. These are the main arteries of the city, how Londoners get around.

Last year, 1.37 billion journeys were made on the London Underground. That's the equivalent of 18% of the world's population taking one journey on the tube.

Suffice to say, the process generally works like a well oiled machine. Changes are clearly marked, and trains are so regular you'll likely never wait more than 5 minutes for the next one at an underground station. In central London, the underground reigns supreme, and you'll never be more than a 5 minute walk from a station.

Night tubes have been introduced relatively recently, which means a 24/7 tube service on Fridays and Saturdays on select central lines.

Plus, although underground, you'll still be connected on your commute, with WiFi at underground stations provided by Virgin Media. Currently 97% of the London Underground network is covered by WiFi, which you can use for free if you're with a certain selection of phone service providers.

Out towards the outskirts of the city, or the suburbs, you'll find a network of Overground trains, and the Docklands Light Railway (DLR) in the east of the city. Although these may be run by different franchises, the good news is that it's the same contactless fare process as the underground.

TOP TIP Stand on the right when using the escalator.

Buses, trams and river buses in London

The double decker red bus is instantly linked with London, and there's a good reason for that.

The buses are everywhere, providing regular connection across London. Many of the bus services are 24/7, so are a key lifeline when the bulk of the London Underground closes between midnight and 5am.

Keep in mind there is no way to pay with cash on buses, it's all Oyster Cards or contactless. The same can be said with trams, with single paper tickets available at tram stops. You can mix a bus and tram pass on your Oyster card. Keep in mind a hopper fare gives free bus and tram journeys for an hour after your first fare charge.

DID YOU KNOW Last year London buses travelled 490,000,000km across the capital, the equivalent distance of sending three buses to THE SUN.

Data from Transport for London Network Performance report for Buses 2017/18

Although the river transport services are used mainly by tourists, the river buses are worth a mention. Aside from the leisure cruises, a commuter service runs every 20 minutes Monday to Friday as an alternative to the tube and buses. You can use your Oyster or contactless card too!

Save on your move to London

Get your free quotes and save up to 70% today!

Cycling in London

Everyday, more than 600,000 cyclists commute in London.

Although sometimes described as a risky affair, it's in fact safer than ever to cycle in London.

There are a range of cycle 'Superhighways' for commuters, which are dedicated two-way cycle tracks separate from cars connecting the outskirts of London with the city centre. London offers a variety of large secure cycle parking areas dotted around, but with a huge amount of bike theft reported every year, make sure you invest in at least two high quality locks.

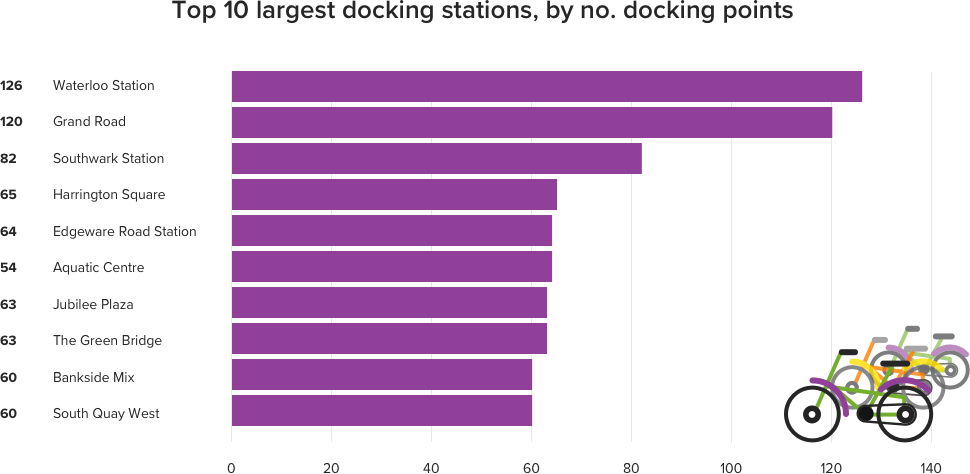

If you don't own a bike, you can still cycle using 'Boris Bikes', or Santander Cycles. The bikes are found spread between 750 docking stations, around every 300 metres in central London. The scheme sees easy, cheap access to bikes across London, with free journeys of up to 30 minutes.

The scheme has been hugely successful, and has seen 67.5 million bike hires since its launch in 2010. You'll be able to find the biggest concentration of hire bikes in the centre of London, with Waterloo Station topping the list with 126 docking points.

TOP TIP Folding bikes are allowed on all underground and overground train services.

Taxis in London

Although the black cabs are iconic, taxis are likely to be the most expensive way to travel in London.

However, black cabs are professional, trustworthy, and generally lead to great conversations. Although it's likely as a hardened Londoner you'll use other means of transport, the dependable black cab will save you from a long walk at least once.

Hail any black cab with the 'for hire' sign lit up. You can also use the Gett app to organise black cab trips, and even organise a shared commute with 'Gett Together' for a £3 ride in a black cab.

Currently Uber has lost its licence in London, but continues to operate as normal while the appeals process continues. Although once again an expensive way of travelling, if you're splitting a fare, the cost becomes more manageable.

Compare the best moving companies

Enter your postcode and start comparing today

Driving in London

We don't recommend owning a car if you're living in London.

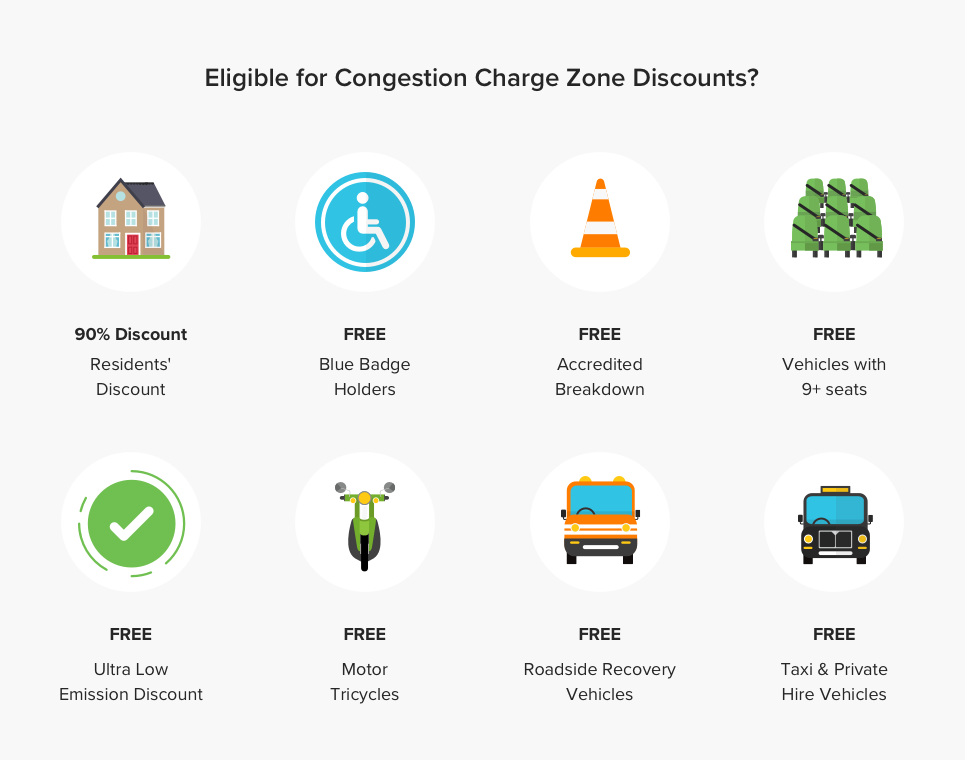

With well connected public transport, the need for a car is minimised within London. Not to mention the busy roads, lack of parking, and cost of running a car. But if you are going to drive, keep in mind the congestion charge zone in central London, as well as the red routes.

The charge is £11.50 for driving within the congestion zone in central London during working hours. Red routes on the other hand are main roads governed by a range of rules designed to keep traffic flowing. These include enforcing no parking, banning certain turns, and prohibiting driving in the bus lane.

It's worth keeping in mind the numerous car club schemes across London, which allow you access to a car if and when you need one. Car club vehicles are kept in specific parking bays across London, and can be booked by members for a flexible amount of time. You'll pay for the time you've booked the car, but won't have to pay extra costs like insurance, MOT or repairs.

Compare house removals

Get your free quotes and save up to 70% today!

The best apps for commuting around London

Many of these apps will be used by even the most experienced Londoner, and are a great way of learning your way around London.

From plotting a range of transport options between you and your destination, to arranging for a light-night taxi, these are the apps to keep close to hand.

Tips for getting around in London

- Two stops on most tube lines are around 15 to 20 minutes walk above ground, so walking is always an option.

- Many employees have cycle schemes, racks and showers. Do a few practice runs of commuting to check timing and routes.

- Stay right if you're standing on the escalators, walk on the escalators on the left.

- Always move down the platform length, as the centre is usually the most busy.

- Note exactly where the train doors will open on the platform on your regular commute. If in doubt, where the yellow lines on the platform are most faded is usually where the doors open.

- Buses are generally slower than the tube, but can be a great way of exploring the city when you first arrive. You can explore above ground during your commute.

If you're going to live in London you'll need to master the commute, and we hope this chapter has prepared you for what to expect when travelling around the city.

It may feel confusing to begin with, but give it a few weeks and you'll be a maestro both underground and overground.

Is Moving to London Worth it?

Moving to London is worth it, and in our final chapter we explain why.

We'll look at the pros and cons of each aspect of living in London, assessing the advantages and disadvantages you'll face after your move.

Buying and renting in London: Pros and Cons

Average house prices from UK House Price Index February 2018

Average rent taken from SpareRoom Index: accessed May 2018

Verdict:

The cost of housing in London is perhaps the main disadvantage of living in London, but the situation is far from hopeless. You'll need to accept that you could get more space for your money in other UK cities. But there are more affordable areas across London. In Outer London especially, there are affordable areas which are closer in price and rent to other major cities such as Bristol and Edinburgh.

Getting on the property ladder will be harder than other places across the UK, but with a range of schemes to help you, it is possible.

Compare the best moving companies

Enter your postcode and start comparing today

Cost of living in London: Pros and Cons

- You'll save from usual travel costs by not having a car in London.

- Planning and budgeting each month will mean more expendable income.

- A monthly grocery shop is cheaper than some cities such as Edinburgh.

- Living in an affordable area will significantly bring down your living costs.

- Londoners have higher salaries than the UK average, which helps you afford the higher cost of living.

- Travel costs and passes are much more expensive than other UK cities.

- High rent prices are the main culprit for the high cost of living in London, with the monthly cost of living in London amounting to £1,951.

- The average Londoner will have less expendable income than other UK city dwellers, with £439 left over each month.

Cost of living data taken from Numbeo May 2018

Verdict:

High rents do much to increase the cost of living in London, which is the highest in the UK. So tackling rent costs by living in a flatshare or an 'up and coming' area is a surefire way of saving money each month. With the average Londoner earning nearly £8,500 more than the UK average, the high cost of living in the capital is softened. All together, if you stay aware of your finances and properly plan and budget, the cost of living in London can be drastically lowered.

Save on your move to London

Get your free quotes and save up to 70% today!

Working in London: Pros and Cons

- The average London salary is £37,209, compared to the UK average of £28,758.

- You could enjoy a wage increase of nearly £8,500 by moving to the capital.

- London wages are 29% higher than in Birmingham, 28% higher than in Glasgow and 24% higher than in Manchester.

- Some job sectors such as finance enjoy a huge boost over the UK average for the sector. Financial workers in London earn £73,290 on average, £32,450 more than the UK average for the sector.

- The latest employment figures highlight 5,836,000 full time jobs in London.

- Like anywhere, the London underground can see thousands flock there each morning resulting in extremely busy trains.

Data taken from Annual Survey of Hours and Earnings (ASHE)

Verdict:

An increased wage is a huge benefit from living and working in London, with every sector enjoying wages higher than the UK average. It'll be worth working out how much more your particular job might be paid in London, which you can then compare to the increase in living costs.

Certain sectors such as finance and education see significantly higher wages than the UK average. If you do your research it'll soon become clear that a new job in London will be one of the biggest reasons for your move.

Compare the cost of moving to London

Get your free quotes and save up to 70% today!

Lifestyle in London: Pros and Cons

- London is home to the world famous underground ensuring commuters are extremely well connected.

- If you're moving to London with your family then Bromley, Sutton and Hillingdon are a few of the many affordable and family friendly areas to live.

- If you're moving to London for university, it's good to know that it's home to some of the highest ranked specialist and multidisciplinary universities in the world.

- London boasts beautiful parks, greenery, libraries, cathedrals and museums.

- London is famous for its vibrant social scene with a variety of restaurants, bars, cinemas, music venues, cafes etc.

Verdict:

The vibrant and varied lifestyle that London offers will be the main benefit you'll experience from moving there. With 13% of the entire UK population living in London and people constantly flocking there, there's no surprise that most boroughs present a great community feel.

Home to some of the top universities in the world, the largest library globally and a huge variety of places to eat and drink, London mixes its rich history with a modern vibe.

How much will it cost to buy in London

Calculate nowConclusion:

Though cost of living and renting may be higher in the capital, the higher wages and unmatched social scene make the move to London the right decision.

London is a world city, and you'll be joining 8.7 million fellow Londoners living and working in the capital. Plan your move, understand all the costs involved, and your new life in London will be the best decision you've made.