If you die without a will, your assets are legally required to be shared out according to the Rules of Intestacy, which prioritise close family members.

Your spouse or civil partner inherits first, followed by your children, and then your grandchildren if your children have already passed away.

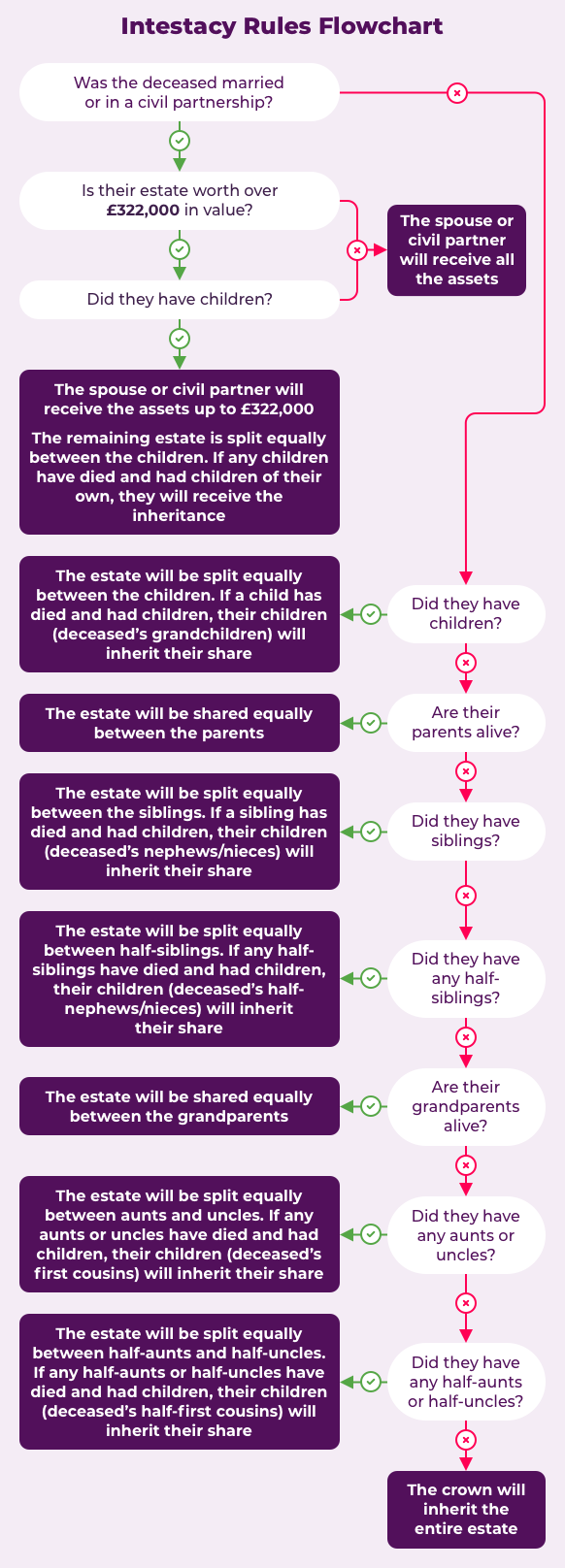

For a complete breakdown, see the flowchart below.

Compare & Save on Will Writing Costs

Accredited and regulated will writers

Used by over 1 million people

What Are the Intestacy Rules in the UK?

Intestacy rules are triggered when a person passes away without a will. Even if a person has notified their family of who they would like to inherit their assets, without a will, the rules of intestacy overrules this.

The order of priority details who is legally the most entitled to the deceased’s assets. Typically, spouses or immediate family inherit a deceased person’s assets by default.

| Inheritance Rule | England & Wales | Scotland |

|---|---|---|

| Spouse's Share | £322,000 + half of the rest (if children). | Spouse inherits the family home (up to £473,000), furniture, and a cash sum (£50,000 if there are children, £89,000 if not). |

| Children's Rights | Split half of what remains. | One-third (if spouse) or half (if no spouse) of moveable assets. |

| Parents & Siblings | Inherit only if no spouse or children. | Share estate if no children (even if spouse exists). |

| House Rights | Not automatically inherited. | Spouse has a legal right to the home (if within limits). |

| Legal Process | Fixed hierarchy. | "Prior Rights" and "Legal Rights" apply first. |

As you can see, the Rules of Intestacy in the United Kingdom vary. England and Wales follow the same process while Scotland’s laws differ slightly. It’s useful to hire a solicitor trained in Scottish law if you are involved in the probate process in Scotland.

How Long Does the Intestacy Process Take?

On average, the probate process with intestacy included will take between 6 and 12 months to complete. This can vary significantly depending on personal circumstances.

The size of the estate, how complicated the order of priority is and any disputes can lead to intestacy taking longer to determine and complete.

Read more on why does probate take so long?

What is Partial Intestacy?

Partial intestacy is triggered when a person dies with a valid will that doesn’t include all their assets or estate. The remaining estate not included in the will must then be distributed by the laws of intestacy.

Compare & Save on Will Writing Costs

Accredited and regulated will writers

Used by over 1 million people

Can Intestacy be Contested?

In some cases, you may be able to make a claim if you were financially dependent on the deceased and haven’t been provided for under the intestacy rules.

Under the Inheritance (Provision for Family and Dependents) Act 1975, certain people can apply for reasonable financial provision from the estate.

You may be able to make a claim if:

You were a financial dependent of the deceased but not a child or spouse

Your inheritance under intestacy is insufficient

You lived with the deceased person but weren’t married or in a civil partnership

To apply, you must complete a Form CH35. A solicitor can help you, and claims must be made within six months of the grant of representation being issued.

Who Can't Inherit Under the Rules of Intestacy?

Many people who might seem entitled to inherit do not under intestacy laws. These include:

Unmarried partners

Relations by marriage (e.g., step-parents, step-siblings, in-laws)

Friends

Carers

Charities

Foster children

Distant relatives (e.g., second cousins)

Adopted children inherit from their adoptive parents like biological children but do not inherit from birth parents unless named in a will.

Who Pays for Funerals When Someone Dies Intestate?

The funeral of the deceased is typically paid for using their estate as banks can release funds to cover the funeral expenses. If there aren’t enough funds to cover this, the person arranging the funeral will be liable to cover the costs. This is usually the administrator responsible for the estate or the closest available relatives.

Compare & Save on Will Writing Costs

Accredited and regulated will writers

Used by over 1 million people

How to Find an Expert Will Writer

Here at Compare My Move, we can connect you with up to 6 trusted and verified will writers in the local area. All our partners have passed our strict verification process. We can also help you to save on your will writing costs.

Simply fill out our online form to find the best will writer for you. Each is approved and regulated by either:

Solicitors Regulation Authority (SRA)

Council for Licensed Conveyancers (CLC)

Law Society of Scotland (LSS)

The Law Society of Northern Ireland (LSNI)

Chartered Institute of Legal Executives (CILEX)

The Institute of Chartered Accountants (ICAEW)

Institute of Professional Will Writers (IPW)

The Society of Will Writers (SWW)